Achha Kiya Insurance Liya: GIC’s ₹300 Cr Game-Changing Move

🧭 Introduction

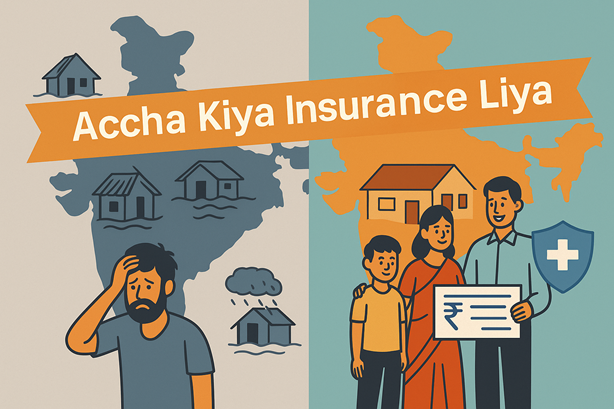

Achha Kiya Insurance Liya — a phrase you’ve probably heard across TV, YouTube, and rural town billboards in recent weeks. But it’s not just a catchy slogan. It marks the launch of India’s biggest insurance awareness campaign to date.

The General Insurance Council (GIC) has unveiled a massive ₹300 Cr initiative aimed at educating and nudging Indians toward general insurance. But in a country where 800 million people know about insurance but don’t trust it, a campaign like Achha Kiya Insurance Liya was long overdue:

Is ₹300 Cr enough — and is India even ready?

🕰️ Why This Campaign, Why Now?

Despite a rapidly growing digital and financial landscape, India’s general insurance penetration continues to hover under 1%. That’s not because people don’t know — it’s because they don’t believe in insurance.

Recognising this trust gap, IRDAI and GIC joined forces to launch a nationwide message that feels more like a conversation than an ad.

Designed by MullenLowe Lintas, the campaign features pets like Barfi and Oscar narrating insurance stories in 12 Indian languages — warm, emotional, and free from jargon.

🎙️ Voiceovers by legends like Ila Arun, Raghubir Yadav, Archana Puran Singh add local authenticity. The campaign will run on TV, digital, OOH, IPL slots, and radio, targeting 200+ Tier 2 and rural towns.

📊 The Big Budget: ₹300 Cr in Perspective

The ₹300 Cr isn’t a lump sum — it’s spread over 3 years, at about ₹100 Cr/year. The mission?

Reach over 800 million Indians with a consistent, relatable insurance message.

Now do the math:

₹100 Cr / 800 million people = just ₹0.12 per person annually.

This proves one thing: the campaign is a mass-level awareness push, not a deep conversion engine.

But here’s the thing — even a 1% improvement in buying behaviour could mean ₹2,000+ Cr in new premium for the industry. That’s a 20x ROI on just the first year’s spend.

👉 According to Economic Times, GIC and IRDAI aim to ensure insurance becomes accessible, not just a statistical line.

🔍 Will It Actually Work?

It depends on follow-through.

The Achha Kiya Insurance Liya campaign ticks a lot of boxes:

✅ Simplicity

✅ Rural connectivity

✅ Behavioural design

✅ Mass media firepower

But the challenge lies in what happens after the message lands.

If agents aren’t trained, if pricing stays complex, and if products don’t meet real needs — the message won’t convert to coverage.

It’s not just about views. It’s about decisions.

💬 My View: Mixed, But Hopeful

After 17 years in general insurance — from claims to bancassurance — I can say this confidently:

India doesn’t need more insurance ads, it needs more insurance trust.

And “Achha Kiya Insurance Liya” is a genuine step in that direction.

But its success depends on the ecosystem:

- Better claim service

- Easy digital onboarding

- Product simplicity

If this ₹300 Cr becomes a trigger for all three, it may well be the masterstroke our industry was waiting for.

🧪 What Makes This Campaign Different?

Unlike most insurance ads that rely on fear or financial jargon, this one builds emotion first.

By letting pets narrate human insurance stories, it cleverly uses humour, relatability, and non-threatening voices — a refreshing shift.

Also, this is the first time the entire general insurance industry is speaking with one voice.

Be it private or PSU insurers — all are under one umbrella here.

That’s not just powerful messaging — it’s industry alignment at scale.

🧭 Final Thoughts

Campaigns don’t sell products. They sell belief.

Remember “Mutual Funds Sahi Hai”? It turned a jargon-heavy product into a household idea. The success of Achha Kiya Insurance Liya depends not just on visibility — but on action, simplicity, and trust.

If “Achha Kiya Insurance Liya” can do the same —

We won’t just sell insurance. We’ll build a safer India.

📌 Related Read:

👉 Cooperative Insurance in India: Concept, Possibilities & Roadblocks