Bancassurance in India: What Your Bank Isn’t Telling You

Bancassurance in India: What Your Bank Isn’t Telling You

In recent years, bancassurance in India has emerged as one of the most powerful yet under-discussed drivers of insurance growth. But how exactly does this model work—and is it truly benefiting the end customer? With ₹91,125 crore earned in insurance commissions in FY 2023–24 alone, it’s time we asked some critical questions.

🏦 What is Bancassurance?

Bancassurance refers to the partnership between banks and insurance companies, where banks act as a distributor for life, general, and health insurance products. In this model, the bank earns a commission from the insurer for every policy sold to its customer base.

Unlike traditional agents or brokers, bancassurance leverages existing customer relationships and physical bank branches to drive sales.

In India, the model has matured significantly. Banks now operate under open architecture, which means they can tie up with multiple insurers:

- 3 Life Insurance Partners

- 3 General Insurance Partners

- 3 Health Insurance Partners

This gives customers a broader choice—at least in theory.

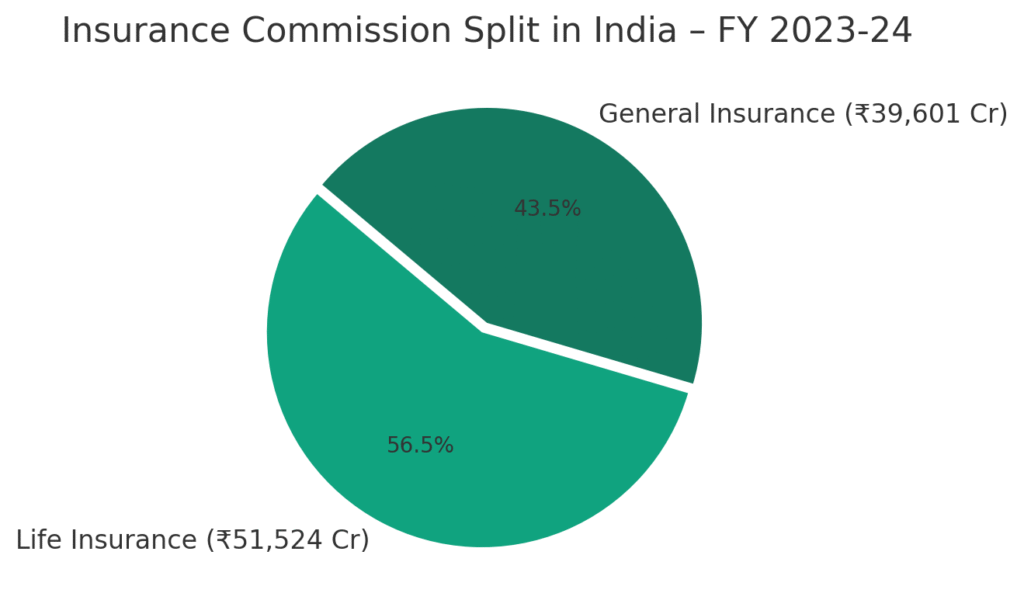

💰 FY24: Record Commission Income

According to industry estimates, banks earned a total of ₹91,125 crore in commissions from insurance sales in FY 2023–24. Of this, India’s top banks accounted for ₹21,773 crore, according to Moneycontrol..

Here’s how it breaks down:

- Life Insurance: ₹51,524 Cr (56.5%)

- General Insurance: ₹39,601 Cr (43.5%)

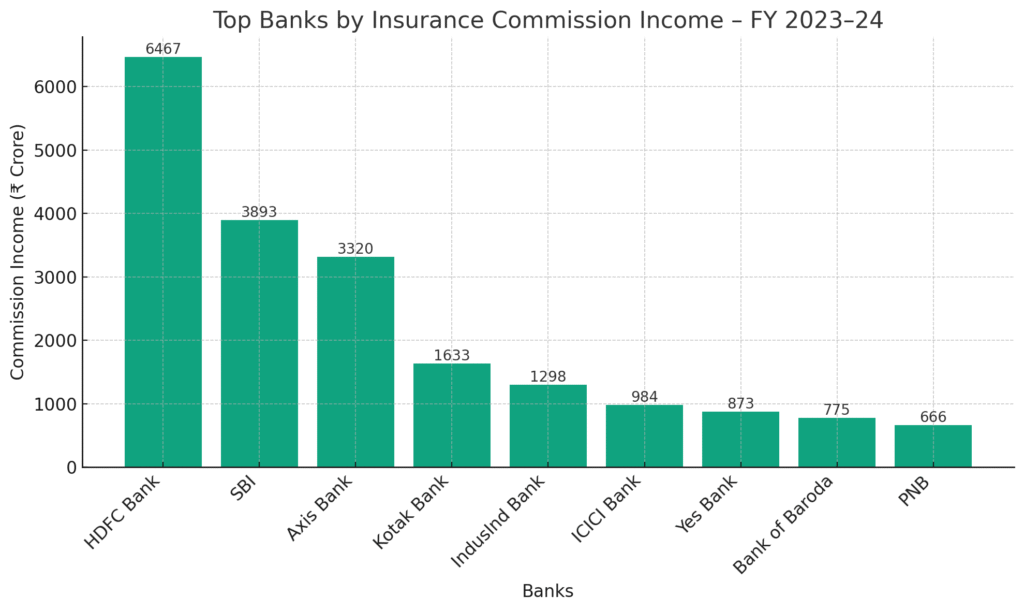

And here’s a look at top performing banks:

🤔 Why Customers Buy from Banks

- Trust & familiarity: Customers trust their banks more than individual agents.

- Ease of purchase: Policies are integrated into digital banking apps.

- Group insurance plans: Especially in general and health insurance, banks offer exclusive group plans with attractive premiums.

For example, an account holder may get access to ₹10 lakh health insurance at lower rates, just for being a preferred customer.

🛑 Reality Check: What’s Going Wrong with Bancassurance in India?

While the model is financially rewarding for banks, it has also led to widespread mis-selling and customer dissatisfaction.

🔹 1. Pressure-driven sales culture

Bank staff have ambitious sales targets—sometimes without proper insurance training. This leads to:

- Selling policies to senior citizens without disclosure

- Pushing long-term life insurance as ‘tax-saving FDs’

🔹 2. Biased product recommendation

Banks mostly push products from their top partner—reducing actual customer choice. Open architecture exists on paper, not in practice.

🔹 3. Lack of post-sale service

Once the policy is sold, the bank staff may not help with claims, servicing, or surrender. Customers are bounced between bank and insurer.

🔹 4. Limited knowledge & training

Most bank relationship managers are not IRDAI-certified advisors. The result is often half-baked advice.

🌍 Bancassurance vs. Global Models

In countries like the U.S., banks typically act as pure sales touchpoints.

- Policy issuance, servicing, and claims are handled entirely by the insurer.

- In India, the advantage is that customers can buy directly via bank portals, giving them control.

✅ Suggestions to Improve Bancassurance in India

- Transparent recommendation engine: Let bank apps show product comparisons across all partners.

- Stronger regulation of mis-selling: IRDAI must audit bank branches like it audits insurance agents.

- Post-sale ownership: Banks should be responsible for servicing or resolving claims, not just sales.

- Customer feedback loop: Integrate Net Promoter Scores (NPS) post-purchase.

- Joint accountability: A shared dashboard between insurer & bank for complaint resolution.

🧠 Final Thoughts

Bancassurance in India is no doubt a revenue jackpot—but it can’t be a customer trap. For banks and insurers alike, trust will be the new currency. The future belongs to those who sell insurance with empathy, not pressure.

Want more insights like this? Visit our Insurance Blog India for weekly stories that decode the insurance world.

📢 Share your thoughts in comments: Have you ever faced a mis-selling situation at your bank?