Cashless Insurance Dispute in India: Why Hospitals Are Saying No

The Cashless Insurance Crisis in India is becoming a major challenge for patients, insurers, and hospitals alike. Health insurance is meant to bring peace of mind. When a patient goes to a hospital, the expectation is that the insurance card will work and the treatment will be cashless. But on 22nd Aug 2025, news broke that more than 15,000 hospitals across India have refused to give cashless treatment for Bajaj Allianz General Insurance policyholders. This has raised a big question: is this only about Bajaj Allianz, or is it a much deeper problem that can affect every insurer and every policyholder tomorrow?

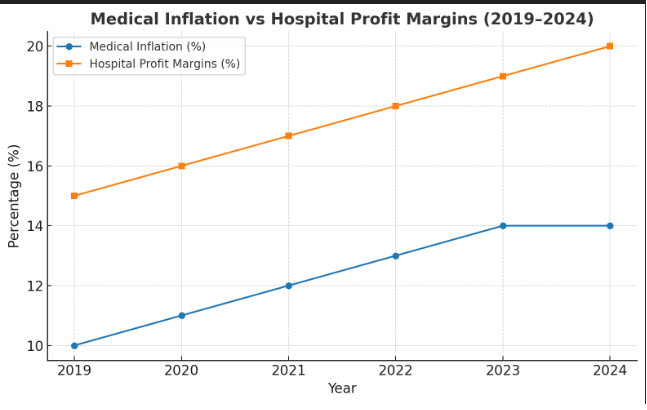

Inflation is Real — But Profits Are Rising Faster

Healthcare costs in India have been rising at a steep 8–10% annually for the last five years, according to a PwC Health Report. Salaries of medical professionals, imported equipment, and even consumables have all become costlier post-COVID. No doubt, inflation is a reality.

However, hospital financials tell another story. The ICRA report projects that operating profit margins for private hospitals remain high at 22–23% in FY2025, even after accounting for inflation. Additionally, hospitals’ revenues are expected to grow 8–10% YoY, buoyed by improved occupancy and ARPOB growth. This data highlights how the Cashless Insurance Crisis in India isn’t just due to rising costs — it’s also driven by hospitals boosting margins at a much higher pace.

The graph above highlights this mismatch — inflation climbs steadily, but profit margins shoot up higher. This indicates that the Cashless Insurance Crisis in India is not just about inflation; it is also about hospitals maximizing revenue.

How Hospitals Justify Denying Cashless Claims

Hospitals argue that insurance companies still pay them based on old tariff packages that don’t reflect today’s costs. They say insurers need to raise reimbursement rates in line with inflation.

But when we dig deeper, some troubling practices emerge:

- Insurers are often billed higher rates than walk-in patients.

- Bills include non-medical items like gloves, masks, or premium room charges.

- Requests for higher package rates are raised without transparent cost audits.

This creates a trust deficit. Patients are caught in the middle of a tug of war, fueling the Cashless Insurance Crisis in India.

Past Evidence: This Crisis Has Been Brewing for Years

This is not the first time India has faced such disruptions. Back in 2010, a similar standoff occurred when insurers capped package rates, leading many hospitals to exit cashless networks.

At TheFinPulse, we’ve covered such issues before:

The Cashless Insurance Crisis in India isn’t new. Even IRDAI’s [Health Insurance Handbook 2023-24] identified delays and disputes affecting 71.3% of health insurance claims, indicating growing system stress.

The Goa Health Model: A Possible Solution

The Goa Health Model provides an interesting blueprint. Under this system:

- Treatment packages are standardized across hospitals.

- Costs for procedures are capped transparently.

- Billing is audited to prevent overcharging.

This ensures balance — hospitals get fair reimbursement, insurers don’t bleed, and patients aren’t denied treatment. If scaled nationwide, such a system could significantly reduce the Cashless Insurance Crisis in India.

The Way Forward

To resolve the Cashless Insurance Crisis in India, several steps are essential:

- Transparent Billing: Hospitals must publish standard rates, audited by independent bodies.

- Indexed Pricing: Package rates should adjust annually for inflation, but not for unjustified profit margins.

- Nationwide Tariff Reform: Similar to Goa’s model, India needs a central framework for hospital pricing.

- Joint Cost Audits: Insurers, regulators, and hospitals should jointly audit claims to build trust.

- Patient Protection: Above all, patients must not suffer. If a hospital denies cashless treatment, there should be penalties.

Final Word

The Cashless Insurance Crisis in India is more than just a corporate dispute — it’s a matter of healthcare accessibility for millions. Inflation is real, but profiteering has made matters worse. Unless India adopts transparent pricing reforms and patient-centric models like Goa’s, this cycle of disputes will keep repeating.

Cashless insurance was introduced to reduce stress during medical emergencies. If not fixed, the current crisis will only erode public trust further — and that’s a loss India cannot afford.