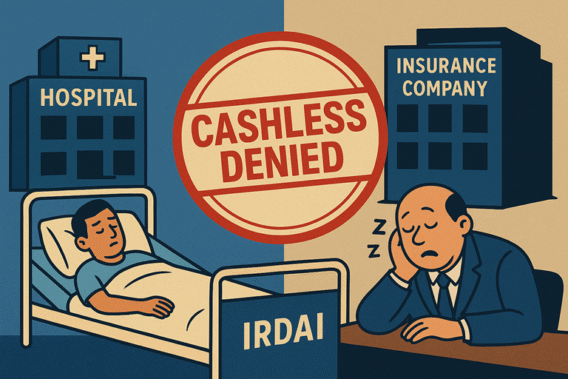

Hospitals vs Insurers: IRDAI Sleeping, Patients Bleeding

Introduction: The Crisis No One Wants to Own

The fight between Hospitals vs Insurers is no longer a behind-the-scenes tussle; it has burst into the public eye. Just last week, over 15,000 hospitals reportedly refused cashless treatment under one of India’s largest insurers. Star Health also saw friction with major hospitals. And the worst-hit? The patients, left stranded in emergencies with bills running into lakhs.

In our previous blog on the Cashless Insurance Crisis in India, we highlighted how the collapse of trust between hospitals and insurers is pushing patients into financial distress. This blog goes deeper exploring why the crisis persists, why IRDAI is silent, and what real solutions India needs to prevent its health insurance sector from total collapse.

The Current Stand-Off: Hospitals vs Insurers

The Hospitals vs Insurers conflict stems from a fundamental mismatch:

- Hospitals claim that insurers underpay, refusing to match rising treatment costs.

- Insurers accuse hospitals of inflating bills, overcharging, and exploiting patients.

- Patients get caught in the middle — neither able to access promised cashless facilities, nor able to afford huge upfront payments.

This deadlock is not just about economics; it’s about survival. At stake is the trust in India’s entire health insurance ecosystem.

Why This Crisis Matters More Than Ever

3–4% households have private health insurance (NFHS-5).

41% households have some form of coverage, including public schemes.

3.7% of GDP is India’s overall insurance penetration, down from 4% in 2022–23 (IRDAI Annual Report 2023–24, Moneycontrol).

Out-of-pocket spending is still over 50% of total health expenditure.

When Hospitals vs Insurers fights reach the public domain, two dangerous outcomes emerge:

- Patients lose faith – “If my policy won’t save me in an emergency, why buy insurance at all?”

- Hospitals turn hostile – “If insurers don’t pay, we won’t admit.”

The result? More Indians either avoid insurance altogether or rely only on out-of-pocket payments, which already push millions into poverty each year.

Is IRDAI Really Sleeping?

The regulator, IRDAI, has issued generic advisories, but there is no binding framework that forces hospitals and insurers to resolve disputes transparently.

Patients are not stakeholders in the current system. Negotiations happen between insurers and hospitals behind closed doors, and the regulator often takes a hands-off approach.

This regulatory silence is what fuels the Hospitals vs Insurers blame game. And unless IRDAI steps in decisively, India risks losing public faith in health insurance altogether.

The Need for a Transparent Pricing Framework

One major pain point is treatment pricing. Unlike developed countries where medical costs are benchmarked, in India there is wild variation:

- A bypass surgery in a Tier-2 city may cost ₹1.5 lakh, while in a metro it can touch ₹6–7 lakh.

- Hospitals argue that land, salaries, and equipment costs vary, making standardization impossible.

- Insurers demand “reasonable and customary” charges but refuse to define what that means.

A realistic middle path is zone-wise hospital pricing, something we argued for in our earlier blog “HOSPITAL PRICING REFORM” on healthcare pricing reforms. Costs can be mapped across metros, Tier-1, Tier-2, and Tier-3 cities to ensure fairness without forcing one-size-fits-all pricing.

Can India Build a UPI-Like Health Settlement System?

One of the biggest lessons from India’s fintech revolution is UPI — a seamless, transparent, real-time payment system.

Imagine a similar system for healthcare:

- A digital cashless claims platform, built with hospital, insurer, government, and patient representatives onboard.

- Patients would know in advance how much of the treatment is covered.

- Hospitals get instant claim settlement without weeks of paperwork.

- Insurers get audit trails to prevent inflated billing.

The question is — who will build it? A private player (like NPCI did for UPI)? Or will the government finally take ownership through IRDAI and the Health Ministry?

What Needs to Happen Next

The Hospitals vs Insurers war cannot be allowed to continue unchecked. Three urgent actions are needed:

- Government Intervention – IRDAI and the Health Ministry must step in with enforceable norms on pricing, cashless protocols, and grievance redressal.

- Zone-Wise Pricing Model – Standardized treatment rates based on location and infrastructure realities.

- National Cashless Claims Grid – A UPI-style, interoperable platform where hospitals, insurers, and patients operate with complete transparency.

Conclusion: Patients Cannot Keep Bleeding

The headline may sound dramatic — “Hospitals vs Insurers: IRDAI Sleeping, Patients Bleeding” — but it reflects the lived reality of millions of Indians. Every day, patients with valid policies are forced to swipe credit cards, mortgage assets, or delay urgent treatment.

This crisis is not just a corporate dispute; it is a public health emergency. Unless the regulator wakes up and stakeholders build a fair, transparent, and digital-first system, the very idea of health insurance in India could collapse.

India cannot afford to let Hospitals vs Insurers become a permanent battle. It’s time to put patients back at the center of the healthcare system.