Bharat Insurance Growth 2025: Beyond the Metros Boom

Insurance growth in India is entering a transformative phase in 2025. While metro cities have long been the strongholds, it’s now Bharat — Tier 2 and Tier 3 cities — driving the surge in motor, health, life, SME, and even crop insurance. The Bharat insurance growth 2025 trend is no longer a prediction — it’s a powerful reality.

According to a Probus report cited by BusinessWorld, over 62% of new insurance premiums in FY25 came from Tier 2 and Tier 3 cities. Meanwhile, growth in metro cities has slowed down or stagnated in several product categories. This shift not only signals market maturity in the metros but also highlights the untapped potential in Bharat. The numbers clearly reflect the momentum behind Bharat insurance growth 2025, which now dominates insurer strategy meetings and boardroom plans. This clearly marks a turning point in insurance growth in India, where Bharat is no longer catching up — it’s setting the pace.

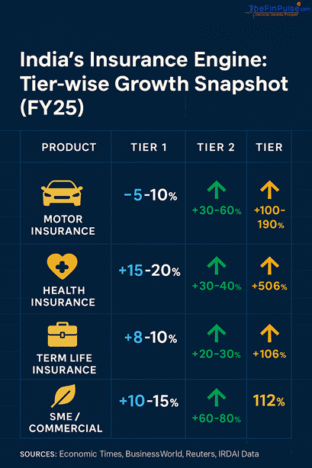

Tier-Wise Growth Snapshot

Below is a visual representation of product-wise growth across different city tiers:

This shift marks a major milestone in the overall insurance growth in India, especially in underpenetrated regions. Tier 2 cities like Indore (+31%), Jaipur (+191%), and Lucknow (+15%) are seeing a huge jump in motor and health insurance penetration, driven by PoSP networks, digital onboarding, and vehicle financing.

Even Tier 3 towns such as Udaipur, Bhilai, and Muzaffarpur are contributing significantly through small-ticket health plans, micro life policies, and government schemes. The affordability of bite-sized premiums and trust in local agents are driving penetration here. This explosion of demand is a testament to the strength of Bharat insurance growth 2025 as a real-time transformation, not just a buzzword.

Private vs Public: Who Leads Where?

The rise of Bharat also highlights a clear trend in how private and public insurers are performing across geographies:

| Product | Public Insurers (LIC, PSU GI) | Private Insurers |

| Motor Insurance | Flat / modest growth | Strong Tier 2/3 penetration |

| Health Insurance | Focused on group & govt schemes | Leading in retail & hybrid |

| Life / Term Insurance | LIC dominant in Tier 3 | ICICI, HDFC, Max strong in Tier 2 |

| SME Insurance | Slower, less flexible | Custom SME & MSME products |

| Crop Insurance | PSU-led via PMFBY | Minimal presence |

LIC still dominates rural life insurance, but private players like Niva Bupa, Digit, ICICI Lombard, and Care Health are playing a larger role in fueling insurance growth in India, particularly beyond metros. In SME and motor segments, flexible digital-first offerings from private insurers have pushed PSU firms behind.

Private insurers are also leveraging AI-powered underwriting, WhatsApp-based servicing, and vernacular support to win customers. In contrast, public insurers continue to rely on traditional channels.

Additionally, embedded insurance tied to consumer durables, loan protection, and ride-hailing services is helping insurers reach deeper into Tier 3 populations. Many startups are also partnering with NBFCs and MFIs to offer bundled insurance with credit products. All of these are accelerants of Bharat insurance growth 2025 across underserved markets.

Why Bharat Is Growing Faster

Below factors have led to rapid and inclusive insurance growth in India, with Tier 2 and Tier 3 cities emerging as the new frontier.:

- Digital PoSP and aggregator expansion

- Government schemes like PMJAY and PMFBY

- Increasing smartphone & UPI penetration

- Regional language support in apps and communication

- Rising health awareness post-COVID

- Affordable premiums and micro-insurance bundles

- Youth population pushing for digital-first protection plans

These regions are also underserved historically, which makes them fertile ground for new policies. The insurers that recognize this fertile soil are reaping early-mover advantages — another key marker of Bharat insurance growth 2025 playing out in real time.

What This Means for the Insurance Industry

- Insurers must localize marketing and offer hyper-personalized products.

- Hybrid products like term + health combo plans are more appealing in Tier 2/3.

- PoSP agent networks and embedded insurance will play a larger role.

- Digital claim settlement and vernacular onboarding will become standard.

- Need for regional underwriting guidelines tailored to local demographics

- InsurTech collaborations with local partners will accelerate trust-building

For insurers aiming to lead in the coming decade, aligning strategies with the dynamics of Bharat insurance growth 2025 is not optional — it’s imperative.

Internal Links:

External Links:

Conclusion:

The future of insurance growth in India lies in how well insurers adapt to Bharat’s evolving needs.. Bharat is now the engine, and insurers who recognize this shift early will lead the next phase of expansion. Going forward, success will depend on how well insurers serve smaller towns with relevance, speed, and empathy.

With regional digital infrastructure improving and Bharat’s young population coming online rapidly, the momentum is only going to get stronger. With Tier 2 and Tier 3 cities continuing to lead the charge, the trajectory of insurance growth in India is set to become even more inclusive and impactful. The insurers who act today will define India’s next decade of inclusive insurance growth. And at the center of this shift lies one defining trend — Bharat insurance growth 2025.